Quiz questions collected by Roger (Generated by incFileListGen.m)

Student ID:

Name:

DP

- (20)

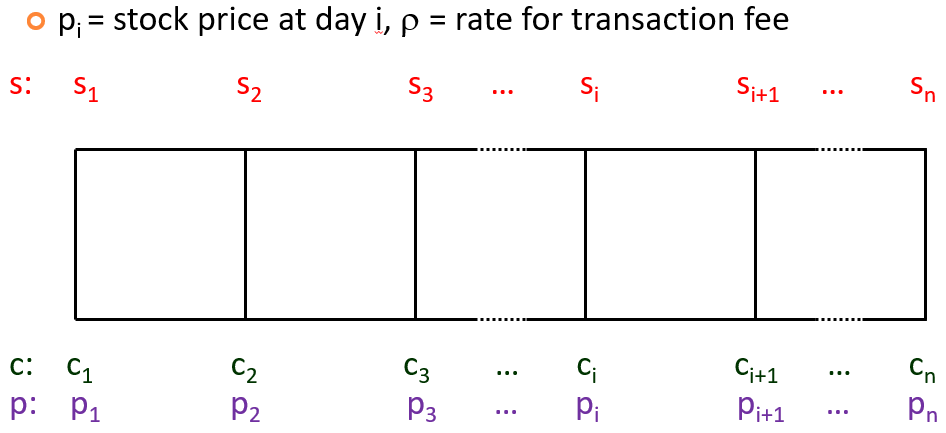

Example of DP for trading:

Given a price vector of [2 1 3 4 5 2], we want to use DP to find the max return, as described in the class, with the assumption that there is no transaction fee, and the initial cash is 10.

- What is [ ], the max. cash at each stage?

- What is [ ], the max. stockholdings at each stage?

- (20)

Formula of DP for trading:

As described in the class, we can use DP to solve the trading problem when all the price information is known in advance. With the same assumptions as described in the class, please use DP formulation to maximize days' return, with the rate of transaction fee equal to and the initial cash equal to .

- Define the optimum-value functions.

- Construct the recurrent formulas for the optimum functions, together with the initial conditions.

- Specify the answer to the problem of maximum cash return.

Financial quotient

- (20)

台股上市櫃公司總數:

整個台股上市櫃公司總共有幾 N 家,請問 N 的範圍?

- N < 500

- 500 < N < 1000

- 1000 < N < 2000

- 2000 < N < 3000

- 3000 < N

- (20) 台股每家公司的每日漲跌幅的限制: 台股每家公司的每日漲跌幅的限制是正負百分之幾?(請寫數字即可,不加百分比)。 [Financial quotient#fq02.inc]

- (20)

基本面名詞:

Give the full names (in English) of the following terms.

- EPS

- ROA

- ROE

- PER

- PBR

- (20)

基本面名詞之二:

Give the full names of the following terms.

- PER

- PBR

- (20)

股票殖利率:

下列何者是對的?

- 股票殖利率是長期存股的一項重要考慮因素。

- 殖利率的計算,通常包含現金配息及股票配息。

- 股票在除息後若無填息,則殖利率還是無法代表真正的收益。

- 目前銀行的定存年利率大約是 1% 左右,而台股近年來的平均殖利率可以超過 3%。

- (20) 分析股票的四大面向: 請問什麼是分析股票的四大面向? [Financial quotient#stockAnalysisMethodfq0.inc]

IRR

- (20)

IRR comparison:

有兩個投資案如下:

- 十年後的總報酬是 100%

- 六年後的總報酬是 55%

- 以年化報酬率來看,何者比較好?A 或 B?

- 若兩者年化報酬率的差距為 ,請問 等於多少?(請四捨五入至整數。)

- (20)

IRR comparison:

有三個投資案如下:

- 5 年後的總報酬是 50%

- 10 年後的總報酬是 100%

- 15 年後的總報酬是 150%

- 20 年後的總報酬是 200%

- (20) IRR computing: Given a cash flow of , with yearly payment/collection and yearly compounding. What is the corresponding IRR of this cash flow vector, assuming it is less thant 100%? [IRR#computing.inc]

- (20) IRR computing: Given a cash flow of , with yearly payment/collection and yearly compounding. What is the corresponding IRR of this cash flow vector? [IRR#computing02.inc]

- (20) Cash flow from IRR: Given two potential IRRs of 0.2 and -0.5, derive the minimum (in terms of norm) 3-term cash flow of integers corresponding to these two IRRs. [IRR#computing03.inc]

Morgage

- (20) Morgage computation: 假設你買了一棟房子,總價是1000萬元,沒有寬限期,房貸利率約是2%,採用本利等額攤還。若房貸期限為20年,請問每個月應付的房貸金額約為多少萬元?(請以萬元為單位,並四捨五入至整數。) [Morgage#compute01.inc]

- (20)

Morgage computation:

假設你買了一棟房子,總價是5400萬元,沒有寬限期,房貸利率約是2%,採用本利等額攤還。若你可以選擇房貸期限為20年和30年,請問在這兩種條件下,每個月應付的房貸金額會相差多少錢?(請以萬元為單位,並四捨五入至整數。)

- 6

- 7

- 8

- 9

- 10

Moving average

- (20) MA computation: 某一檔股票在某 8 個營業日的股價為 [2 4 6 4 6 0 6 8],請計算其對應的 4MA。(為避免出現 nan,前三天請分別使用 1MA、2MA、3MA 來進行計算。) (答案請前後加入中括弧,每個數字使用半形空白分開,例如 [2 3 5 4 3 2 1 3]。) [Moving average#compute.inc]

- (20)

MA computation basis:

有關與均線的計算,請問是用每天的什麼價格來進行運算?來進行技術分析,下列何者是正確的敘述:

- 開盤價

- 收盤價

- 均價

- 最高價

- 最低價

- 以上均可

- (20)

MA crossings:

有關與均線來進行技術分析,下列何者是正確的敘述:

- 當短期均線開始跨越並大於長期均線時,是所謂「黃金交叉」。

- 當短期均線開始跨越並小於長期均線時,是所謂「死亡交叉」。

- 「黃金交叉」就一定是「買」的訊號。

- 「死亡交叉」就一定是「賣」的訊號。

- (20) MA definition: 在週線、月線、季線、年線的計算之中,請問用來計算平均的天數各是多少? (答案請前後加入中括弧,每個數字使用半形空白分開,例如 [10 20 30 50]。) [Moving average#define.inc]

Portfolio optimization

- (20)

PO with 2 assets: No correlation:

Given two risky assets as follows:

And the correlation coefficient of these two assets is . We want to perform portfolio optimization with investment weigthing of and for assets 1 and 2, respectively.

- What are the overall (return) and (volatility) when and ? (Please put your answer in the format .)

- What are when ? (Please put your answer in the format .)

- What are the overall , overall , and for achieving the minimum-variance portfolio? (Please put your answer in the format .)

- (20) PO with 2 assets: Efficient frontier of line: In PO with 2 assets, when will the efficient frontier reduce to a straight line? [Portfolio optimization#2assetEf01.inc]

- (20) PO with 2 assets: Efficient frontier of line: In PO with 2 assets, what value of will reduce the efficient frontier to a straight line? (If there are multiple answers, please sort them in ascending order and put them into a vector format [ ].) [Portfolio optimization#2assetEf011.inc]

- (20) PO with 2 assets: Efficient frontier of parabola: In PO with 2 assets, when will the efficient frontier reduce to a parabola? [Portfolio optimization#2assetEf02.inc]

- (20) PO with 2 assets: Zero variance: In PO with 2 assets, when will the overall risk go to zero? What are the weights when this happens? [Portfolio optimization#2assetEf03.inc]

- (20) PO with 2 assets: Formula for minimum variance: In PO with 2 assets, what are the weights for minimum-variance portfolio? Can you derive them using Largange multiplier? [Portfolio optimization#2assetMinVar01.inc]

- (20)

PO with 2 assets: Minimum variance with various correlation coefficients:

Given two risky assets as follows:

Under the following conditions, what are the corresponding overall risk (standard deviation) when we achieve minimum-variance portfolio? (Please round your answer to the second decimal place and express it as "d.dd".)

- (20)

PO with 2 assets: Minimum variance with various correlation coefficients:

Given two risky assets as follows:

Under the following conditions, what are the corresponding weight for asset 1 when we achieve minimum-variance portfolio? (Please round your answer to the second decimal place and express it as "d.dd".)

- (20)

PO with 2 assets: Minimum variance with various correlation coefficients:

Given two risky assets as follows:

Under the following conditions, what are the corresponding overall and when we achieve minimum-variance portfolio? (Please put your answer in the format and round them to the fourth decimal place.)

- (20)

PO with 2 assets: Computation for minimum variance:

Given two risky assets as follows:

And the correlation coefficient of these two assets is . What are the weights at minimum-variance portfolio? What are the corresponding and ? [Portfolio optimization#2assetMinVar05.inc]

- (20)

PO with 2 assets: Slopes at various conditions:

Given two risky assets as follows:

Under the following conditions, what are the slopes of the corresponding efficient frontiers? (Please round your answer to the second decimal place and express it as "d.dd".)

- (20)

Objective functions in portfolio optimization:

In general, for assets, we can combine them to the overall return and risk :

where , , and is the covariance matrix of these assets. What are the objective functions (with suitable constraints) that are commonly used in portfolio optimization?

- , where

- (20)

Most unlikely users of PO:

下列哪一種人最不可能用到投資組合最佳化(portfolia optimization)?

- 基金經理人

- 自營商的操盤手

- 70 歲的退休老人

- 剛踏入職場的新鮮人

- 投資上億的上市公司老闆

Sharpe ratio

- (20) Sharpe ratio computation: 有一支股票過去 5 天的股價為 [5 6 7 6 8]。若無風險的年報酬率為 1%,請根據這些資料來計算(以年為主的)Sharpe ratio。 (假設標準差的計算公式為 ,並請將答案四捨五入至小數點以下三位。) [Sharpe ratio#compute.inc]

Stock

- (20) Stock divident: 某一支股票的股價為 103 元,今年配發 5 元現金股利和 4 元股票股利,請問除權息後股價為多少元?(請四捨五入至整數。) [Stock#divident.inc]

- (20) Stock divident: 某一支股票的股價為 100 元,今年配發 4 元現金股利和 2 元股票股利,請問除權息後股價為多少元?(請四捨五入至整數。) [Stock#divident02.inc]

- (20) 除權除息後的股票價格: 某家公司現在股價為 81 元,若今年現金股利 4 元,股票股利 1 元,請問在除權除息後,股價應該是幾元? [Stock#divident03.inc]

- (20)

公司基本面評價指標:

某家公司A的今年財務情況如下:

- 共發行10萬股,今年股價80元

- 公司資產共1000萬元,但包含銀行貸款200萬元,所以公司淨值(股東權益)為800萬元

- 今年稅後淨利為100萬元,發放現金股利4元

- 資本額或股本(答案是整數,以萬元為單位,例如「90萬」)

- 市值(答案是整數,以萬元為單位,例如「200萬」)

- EPS (earnings per share)(以元為單位,四捨五入至小數點後第一位,例如「11.2」)

- 資產報酬率 (ROA, return on assets)(以百分比為單位,四捨五入至小數點後第一位,例如「11.5%」)

- 股東權益報酬率 (ROE, return on equity)(以百分比為單位,四捨五入至小數點後第一位,例如「13.5%」)

- 本益比 (PER, price-earnings ratio)(四捨五入至小數點後第一位,例如「3.5」)

- 股價淨值比 (PBR, price-book ratio)(四捨五入至小數點後第一位,例如「2.5」)

- 現金殖利率 (Yield)(以百分比為單位,四捨五入至小數點後第一位,例如「8.5%」)

- (20)

Stock's IRR:

若要計算股票的年化報酬率,有兩種方式:

- 用最後的資本利得+總股息配發,與最初的總投資額去算

- 用還原股價計算報酬率

- A 的算法較準確

- B 的算法較準確

- A 和 B 的算法都可以得到正確的結果

- 兩者皆不夠準確

- (20)

Stock's ARR & CDY:

有關於股票的年化報酬率(annualized rate of return)和現金殖利率(cash divident yield),請問下列敘述何者正確?

- 現金殖利率不考慮資本的獲利或虧損

- 殖利率的前提假設是:你的資本投進去就沒有要拿回來了,因此你只考慮未來每年可以拿回多少

- 若要精準計算,年化報酬率是一個比較精確的投資評估標準

- 現金殖利率並不考慮股票股利

Technical analysis

- (20)

Aggregate daily candlestick charts to a weekly one:

Given daily candlestick charts of 5 days as shown next (open, high, low, close):

- (15, 20, 11, 17)

- (18, 21, 10, 16)

- (17, 19, 15, 17)

- (17, 22, 11, 18)

- (19, 23, 14, 19)

- (20) RSI computation: 有一支股票過去 9 天的股價為 [3 1 4 3 4 5 3 6 13],請根據這 9 天的資料來計算 RSI。 (答案介於0和100之間,請四捨五入至整數,且無須加百分比符號,例如 68。) [Technical analysis#rsiCompute.inc]

- (20) Types of technical analysis: 請問在技術面分析方面,最常用到的兩類方法是什麼? (請將答案以全形頓號分開,例如「方法一、方法二」,但不加引號。) [Technical analysis#type.inc]

ZZZ (No topic)

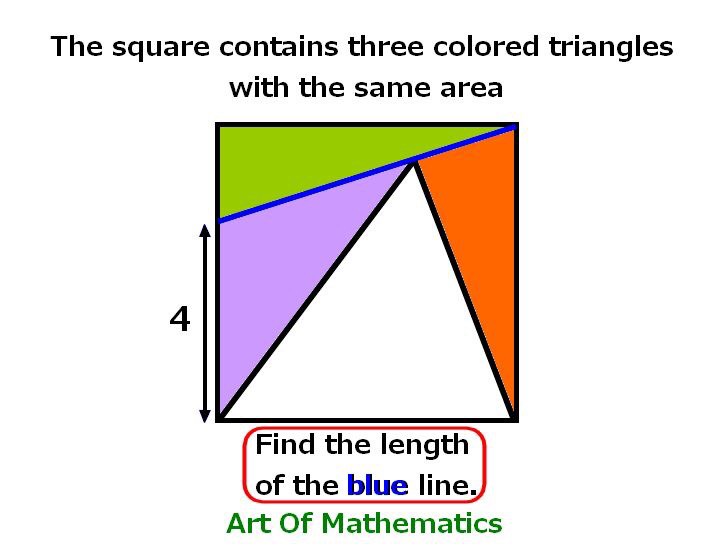

- (20)

Problem of geometry:

[areaProblem.inc]

[areaProblem.inc]

- (20) In-house check: Answer to this question will be given in the class. [inHouseCheck.inc]